A proposal for financing properties acquired by the Philadelphia Land Bank

The Philadelphia Land Bank needs a source of funding to pay for the maintenance of the blighted vacant buildings and lots that it will be acquiring, owning, and holding until they can be conveyed to responsible developers. The best way to generate a substantial amount of funds for this purpose is for the land bank to purchase properties listed for tax collection sale, then resell them with the addition of a surcharge to be paid by successful bidders at closing.

This approach is feasible because Philadelphia tax collection sales consistently attract a large number of bidders, and because the winning bids for properties offered at these sales are substantially lower than their market value.

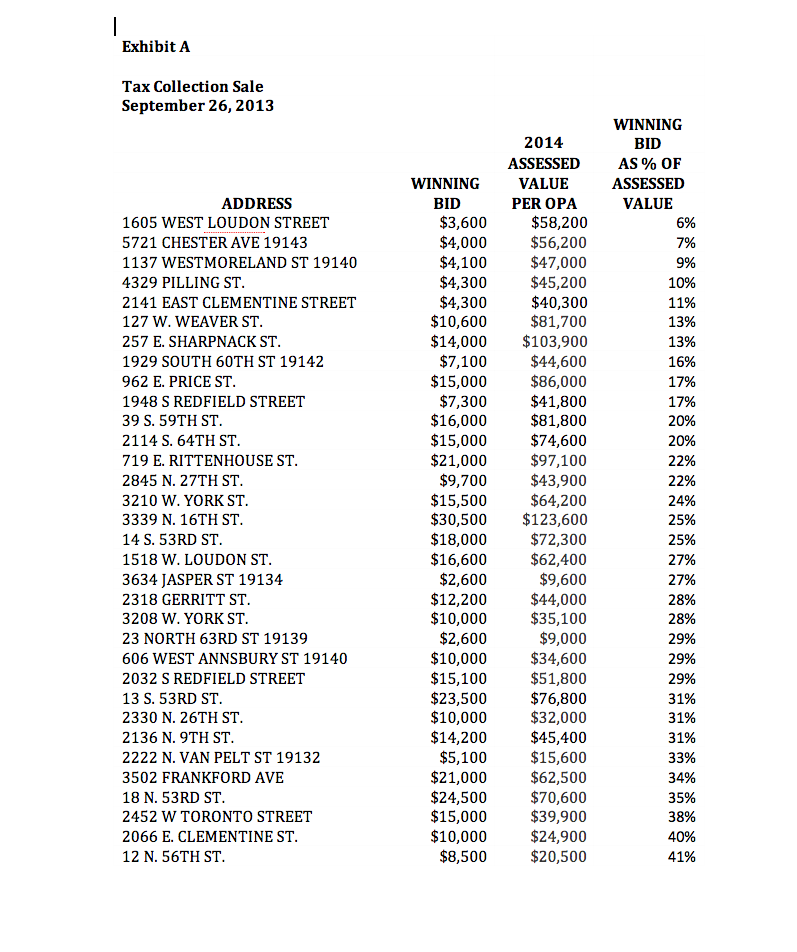

The results of the September 26, 2013 tax collection sale illustrate this situation.

Number of properties sold: 45

Total Market Value of all Properties Sold: $2,296,000 (Source: Office of Property Assessment 2014 Assessed Values)

Total of all Winning Bids at this Sale: $758,700

Total Winning Bids as % of Total Market Value: 33%

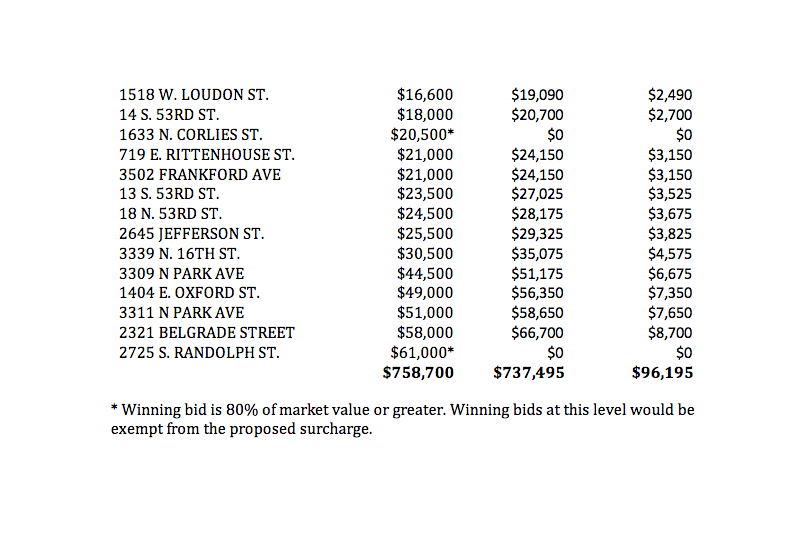

As shown in Exhibit A, winning bids for most of the properties sold were substantially less than half the 2014 market value of these properties, as established by the Office of Property Assessment. Only twelve properties were sold for winning bids that exceeded half their market value, and only three of these properties were sold for winning bids greater than market value.

This pattern, which recurs consistently in Philadelphia tax collection sales, explains why these sales are so well attended: they provide opportunities for participants to purchase, at bargain prices, properties that are located in rising neighborhood real estate markets. It seems unlikely that the addition of a reasonable land bank maintenance surcharge on properties sold would discourage participation in tax collection sales. Even with the addition of a surcharge, bidders would still have an opportunity to buy properties at substantially less than market value.

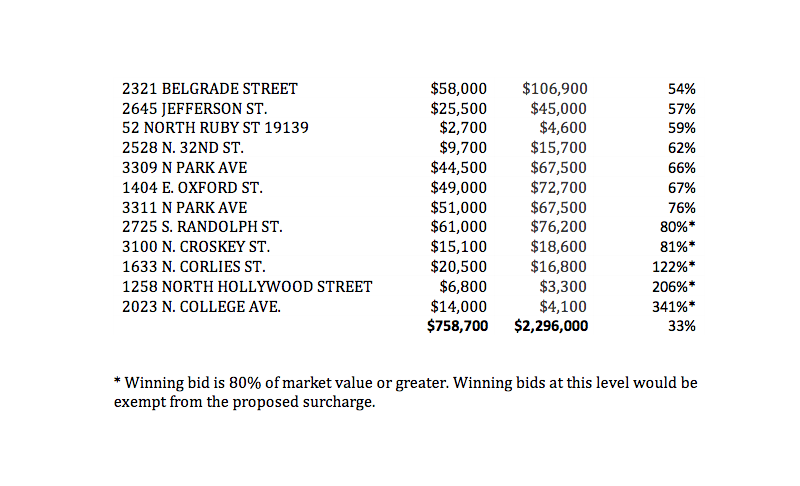

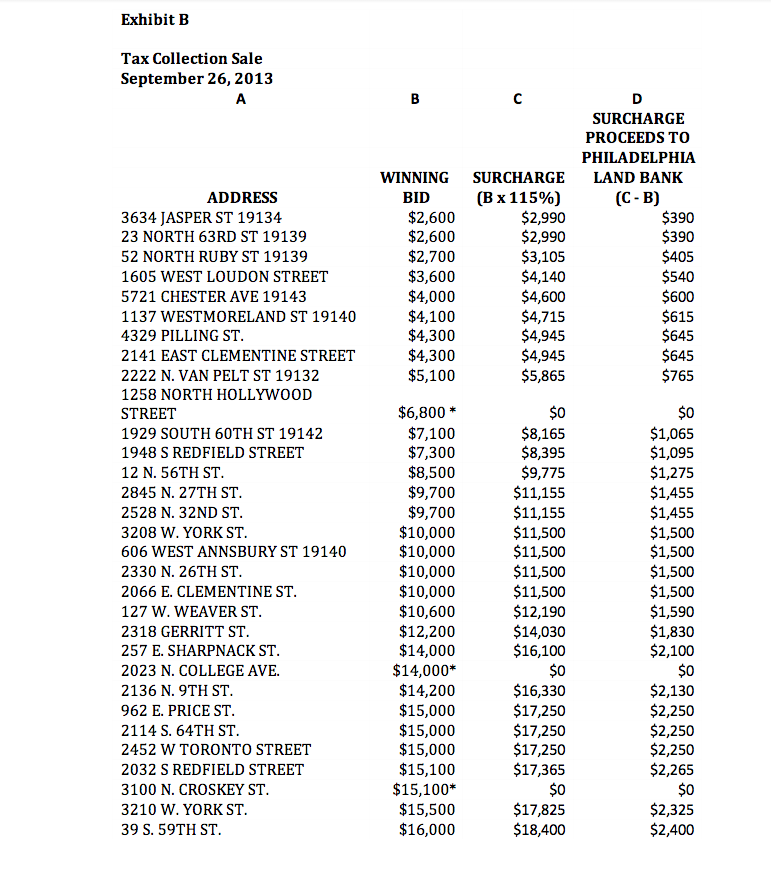

Exhibit B shows that, if a 15% surcharge had been added to the closing costs for winning bids at the September 26 tax collection sale that were less than 80% of market value, the surcharge would have generated $96,195 to support land bank property maintenance expenses. Only five properties at this sale had winning bids at or above 80% of market value; these properties would be exempt from the surcharge.

This approach could be tested at a single tax collection sale involving a relatively small sample of properties located in stable or strong real estate markets, then, if this test proved successful, expanded gradually to include more properties at subsequent sales. Exhibit C describes how this approach would be implemented.

[from September 29, 2013 memorandum to city officials]

Using Land Bank Powers to Generate New Resources for Asset Management

The Pennsylvania land bank enabling legislation would make it possible for a Philadelphia land bank, based on an agreement with the city administration, to acquire properties listed for tax collection sale without having to bid against other participants in the sale. This power could be used constructively to generate a dedicated source of funding for the maintenance of properties in a land bank inventory.

A strategy for achieving this goal might be implemented in the following way.

- In preparing to list properties for a tax collection sale, the city administration and the Sheriff’s Office would perform all of the required due diligence (e.g., publication of advertisements and public notices, notification of lienholders) with no change in this process.

-

All advertisements, notices, and related documentation would include a statement indicating that “The Philadelphia Land Bank may purchase one, some, or all of the properties listed for the tax collection sale” and that “Any properties purchased by the Philadelphia Land Bank are to be withdrawn from the sale.”

-

On the day of the tax collection sale, based on a previously executed cooperation agreement between the land bank and the city administration, the land bank would purchase all properties listed for the sale.

-

At the time advertised as the start of the tax sale auction, it would be announced that, although the Philadelphia Land Bank had purchased all of the properties listed for the tax collection sale (meaning that the tax collection sale would, in effect, be cancelled), an auction of most of the listed properties would take place immediately. A list of properties to be auctioned would be distributed. The list would include all of the properties that had been previously advertised for the tax collection sale, with the following changes: a) properties that the land bank wanted to retain (for conveyance to a qualified developer or for inclusion in a site assemblage plan associated with a city policy or a neighborhood reinvestment plan) would not be included; and b) a surcharge in the amount of 15% of the winning bid would be imposed on all properties sold at the auction.

-

The auction would be conducted in the same manner as the current tax collection auction is conducted. The auction would take place at the same location and would be managed by the same personnel. The only difference would be that the auction would be a land bank-sponsored auction rather than a Sheriff Sale.

-

The proceeds of the 15% surcharge would be used to capitalize a fund managed by the land bank that would be used exclusively to maintain properties for which no bids were received. These properties would be owned by the land bank until an appropriate developer and/or reuse is identified.

As a senior consultant at the Fels Institute of Government, John Kromer provides strategic planning and urban policy development services to government agencies and nonprofit organizations and institutions in Philadelphia, Camden, Pittsburgh, Reading, Allentown, and other cities.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.