A $100 million offer for vacant schools – but how much are they really worth?

The working assumption was that many of our City’s 23 recently closed schools were located in low-demand neighborhoods which is why it was kind of shocking to learn that a Washington, D.C. real estate company offered $100 million for 30 now-vacant school properties. These buildings will eventually be conveyed given the School District’s cumulative budget deficit of $1.1 billion, and although Council President Darrell Clarke has estimated that the portfolio could be worth as much as $200 million, the Mayor has appeared more cautious claiming, and rightly so, that “we do not want to appear to be desperate sellers.” So the question is, how much are these school properties actually worth?

More so, assuming I were a private developer without internal City-owned data and the ability to build otherwise complicated statistical models, how would I estimate the value of these assets?

Our ongoing school crisis keeps our students and neighborhoods firmly entrenched in a poisonous feedback loop. One where lackluster school financing leads to poor school quality which diminishes demand for City locations, further inhibiting growth and tax revenues for schools. Presumably, the rationale for closing a school is that demand for classroom seats is significantly below the capacity that would otherwise make it feasible to educate at that facility.

So when a figure like $100 million comes out of nowhere, people take notice. There is no one city-owned asset more valuable than land. Cities can use land to influence development/land use process (a major rationale for the Land Bank) and collect taxes on land to bolster vital city services like education.

Before any meetings are held with real estate companies or local community groups, the City should make every attempt to estimate the worth of these assets.

Typically, we use a particular flavor of spatial/statistical model to predict the value of the real estate given the site and locational characteristics of previously transacted properties. A couple years back, myself and Kevin Gillen joined forces to estimate the value of the City’s vacant land inventory for what became the Philadelphia Redevelopment Authority’s Front Door land disposition system – a program that brought much-needed transparency and efficiency to the land disposition process.

Although our model proved accurate, it is worth noting the implicit difficulties of predicting the value of vacant properties. Consider two developers attempting to figure out how much one of these vacant schools will be worth in ten years time. First of all, they may not agree on the site’s ‘highest and best use’. One developer may plan to adaptively reuse the site – maybe for condos, while the other may plan to bulldoze the building and rent the land to a Target or a Shoprite. Even more critical is that these developers will have to speculate (read: guess) on market conditions ten years down the road.

Although the City could (and should) use this same sort of statistical model to estimate the current value of vacant schools, I thought I might take a crack at it as if I was an outside real estate firm using only freely available data from the City, some Geographic Information Systems (GIS) software and Excel.

I gathered address-level data on the closed schools; land and building values from the Actual Value (AVI) tax data; parcel data from the Philadelphia Water Department; and some tabular data on the internal square footage of buildings from the Office of Property Assessment.

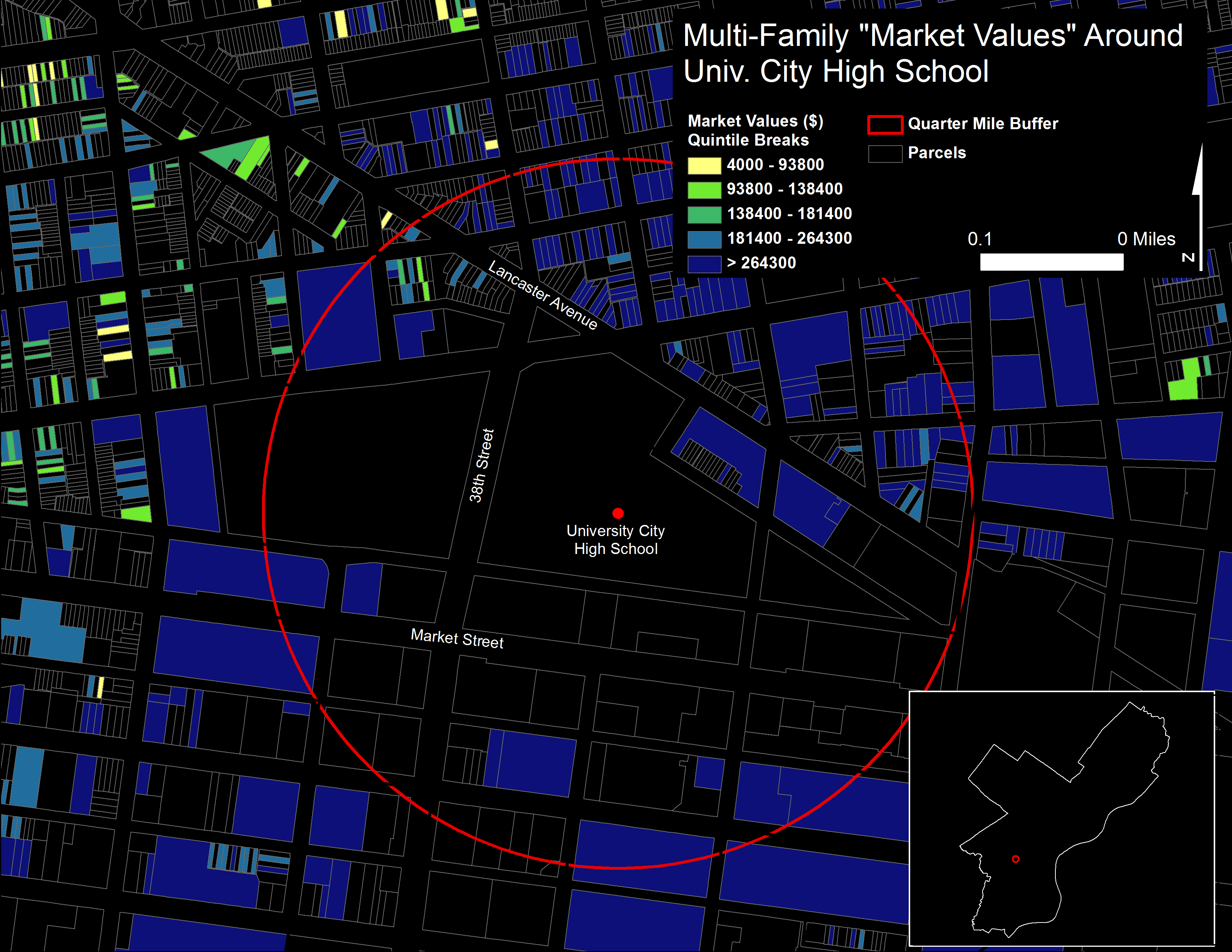

I calculated both the average land and building price per square foot of AVI properties categorized as “Land” and “Multifamily” respectively. Here I’m assuming that a potential developer would like to convert these schools to condos or the like. By assuming that similar land and building values cluster in a very small geographic area, I took the average land and building value within one quarter mile of each school and used this as a proxy for school value.

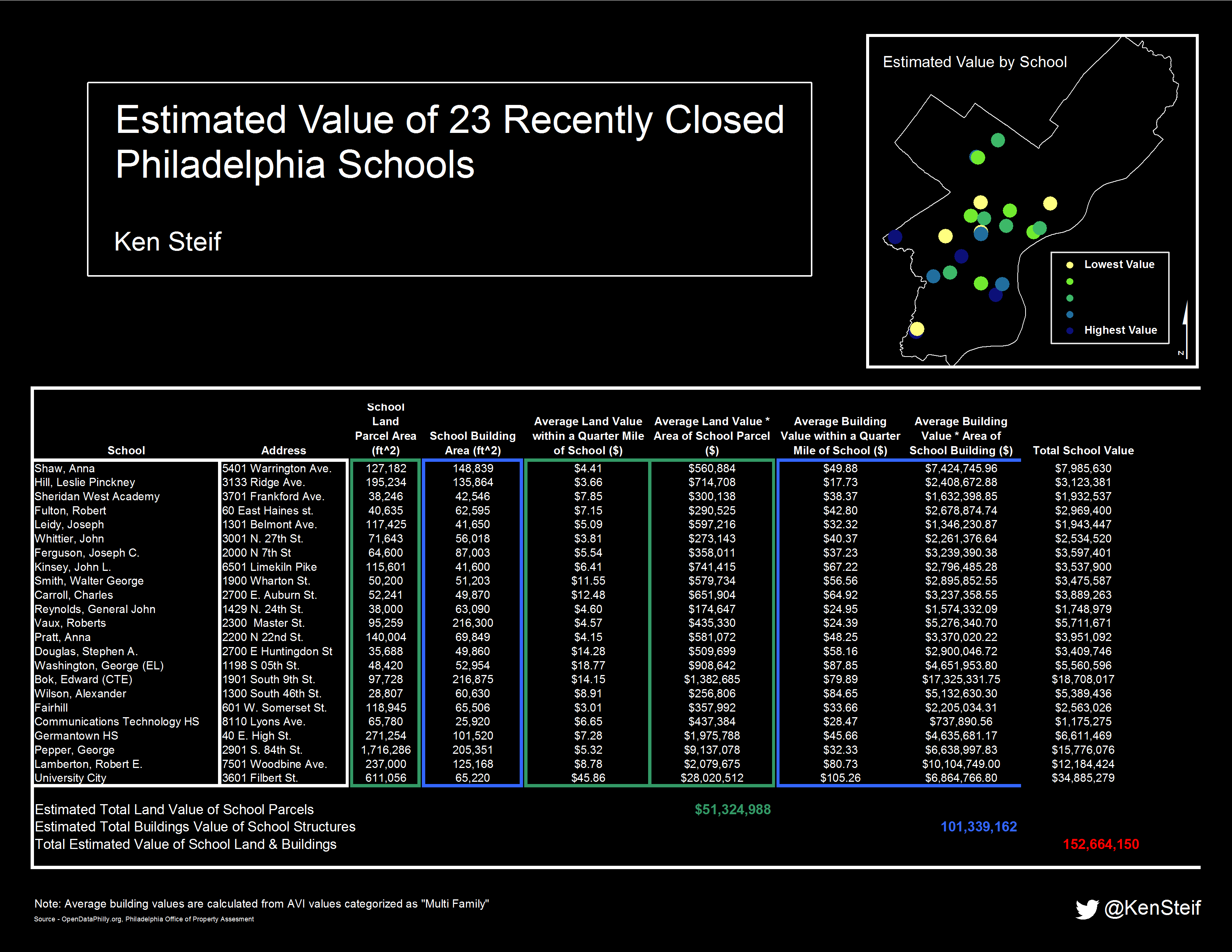

The image below shows that for all 23 properties, the total estimated value of school land and buildings is more than $51.3 and $101.3 million respectively.

Together, the estimated value of the entire 23 school portfolio totals $152,664,150. The estimated worth of University City High School alone is nearly $35 million, which should come as no surprise given the size of the site and the price appreciation that has taken hold over the last decade and a half (see the above image).

Of course, this method makes a number of broad assumptions and makes no attempt to factor in the costs of rehab, permitting, etc.

Nevertheless, considering these estimations are based on Philadelphia’s own (AVI) valuations of land and buildings, why should a real estate developer question the accuracy of the data? Finally, given these values, should we be surprised at the proposed $100 million figure? Probably not – according to our own tax rolls, $100 million is a steal (and this is estimate is only for 23 of the 30 schools in discussion).

It is possible that my ‘guess-timations’ could be completely wrong (maybe there is a lot of variation in the underlying values that comprise the mean).

Nevertheless, the City would be well served to put some of its high resolution administrative data to work getting a better statistical sense of how much each school is worth.

Finally, of all of the policy instruments we can use to ensure the future success and economic vitality of our City and its residents, education is the absolute most critical. Let’s not waste this valuable opportunity to bring in some much needed financing for our schools.

Ken Steif is a Doctoral Candidate in the Graduate Group of the City & Regional Planning Program at the University of Pennsylvania. You can follow him on Twitter @KenSteif

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.