Live! Hotel & Casino partner: We’ve got the right team, the right location and the right program for Philadelphia

Granting the Live! Casino & Hotel project Philadelphia’s remaining gaming license would not only generate the most new revenue for the city and state, said Cordish Company Gaming and Resorts Division President Joe Weinberg, it would also create a more walkable stadium district.

When asked during a recent interview at his Baltimore office why the Pennsylvania Gaming Control Board should choose the Live! proposal by Cordish and partner Greenwood Gaming over the other four applicants competing for the license, Weinberg went straight to the 900 Packer Ave. location

That corner of Packer and Darien Street enjoys proximity to both I-76 and I-95, and Weinberg said this easy on-and-off car access is key to the success of any regional casino.

“And we’re part of the stadium district, which today attracts over 8 million visitors a year with 300 events per year,” he said. “It would be a tremendous driver of traffic for the gaming facility.”

Weinberg said a stadium district casino would also present less direct competition for the existing SugarHouse Casino on Delaware Avenue in Fishtown. “So it will generate the greatest amount of new revenue, and have the least amount of cannibalization,” he said.

The highway access, nearby sports facilities and the distance from SugarHouse may differentiate Live! from two competitors with Center City locations: The Provence at Broad and Callowhill and Market8 at 8th and Market. But two other proposals would be situated in the stadium district – Casino Revolution wants to build at Front Street and Pattison Avenue, and Hollywood even closer at 700 Packer Ave.

Weinberg said the regional casino experience of the Cordish/Greenwood team, which would both own and operate the proposed casino, sets them apart.

“The two Hard Rock casinos that (Cordish) developed in Florida – Hollywood/Ft. Lauderdale and Tampa – are the most successful casinos anywhere in the country, including Las Vegas,” he said. “Our Maryland Live! facility in the Baltimore/Washington corridor, which opened a couple of years ago, is the highest grossing casino in the entire mid-Atlantic region and outgrosses anything in Maryland, West Virginia, Delaware, Pennsylvania and New Jersey,” he said. “Our partners at Greenwood have the top grossing casino in Pennsylvania (Parx in Bensalem). The combination of Cordish and Greenwood have the number one and number two properties in this region already.”

(Note: Last fiscal year, Parx generated the most slots revenue. But Sands in Bethleham generated the most table game revenue. See state reports here. Read The Baltimore Sun’s take on Maryland Live’s performance as the regional slots champ here.)

Weinberg says there is a geographic difference between the three South Philadelphia proposals, too. To most successfully capitalize on the synergy between stadium events and a casino, “you need to create a true integration with the stadium district – a pedestrian friendly linkage. And 10th Street is really the spine to create those linkages with the stadium district, and to XFINITY Live!” which Cordish also owns and operates.

Weinberg describes restaurants and music venues with windows and doors on 10th Street, which he said would encourage walking. “The 10th Street corridor that bounds our property is really a key part to get that walking experience … which you don’t get at the (Hollywood) property or at the (Revolution) property, which is a mile or so down the road,” he said. “People are not going to walk that distance.”

Weinberg also spoke of a planned expansion of Xfinity Live!, which he said now gets 2.5 million to 3 million visitors per year, and the symbiotic relationship that would develop between the sports arenas, XFINITY Live! and the Live! Hotel & Casino.

“The audience coming to stadium events, sports events, concerts and other special events, they are great potential customers for the casino entertainment complex and the hotel as well,” he said. The sporting events and concerts draw from a broader regional market, as people travel from bordering states to see them, he said. That means a broader customer base for Live! Hotel & Casino, he said.

Some critics say the stadiums would actually deter people from going to a stadium district casino, because many won’t want to deal with the game- or concert-day traffic. And that a casino would exacerbate traffic problems for residents.

Weinberg said that the casino and its amenities would persuade concert or game-goers to stay in the area longer, and their more-staggered departure times would help calm traffic while also generating casino revenue.

Meanwhile, people who are coming just for the casino will time their trips to avoid the traffic from other events, just as casino customers everywhere avoid the morning and evening rush hours, he said. (See the traffic studies for this and the other proposals at the PGCB website, here.)

And plenty of customers will come on non-event days as well, some to gamble, some for other casino amenities or XFINITY Live! “People come to XFINITY to experience away games of the Flyers and Eagles,” he said. “They look at it as their stadium even for away games.”

XFINITY Live! and the stadiums would be what Cordish calls a “co-anchor” for its proposed Philadelphia casino. Such an arrangement is a “key ingredient” in the Cordish casino formula, Weinberg said.

“Here in Maryland, we built the largest commercial casino in the country adjacent to the largest regional mall in the country,” he said. “There is tremendous synergy between the mall and the casino.”

For example, he said, December is typically the lowest casino revenue month, but Maryland Live! did cross-promotion with the adjacent mall. “Our December was our strongest month of the year,” he said. “We took what would have been the softest month and turned it into the strongest, by taking advantage of the co-anchor mall.”

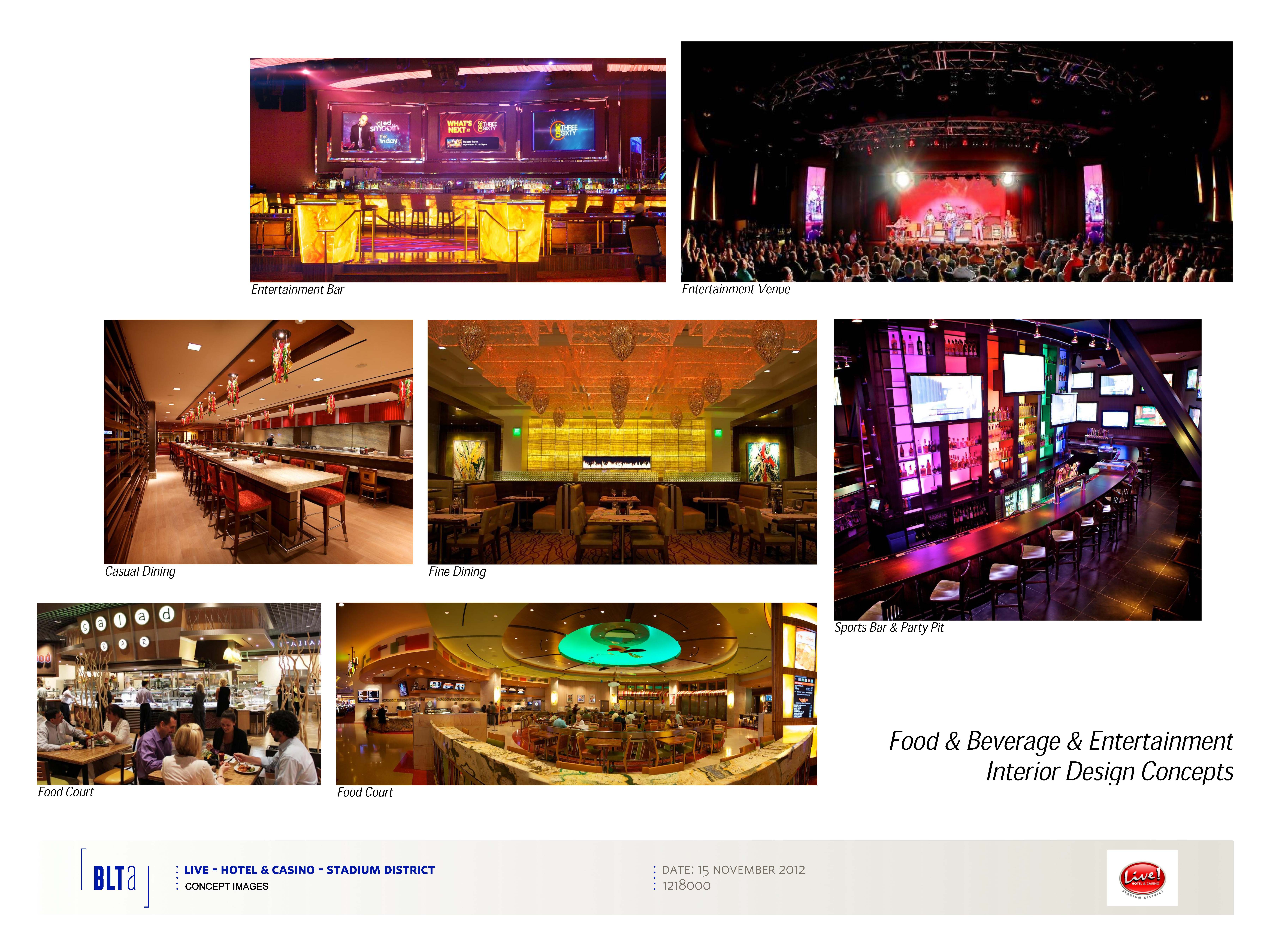

The Hardrock in Hollywood/Ft. Lauderdale didn’t have a co-anchor, so, “We built a very large retail, entertainment village” that includes 13 restaurants, a 6,000 seat live music venue, 10 nightclubs, retail shops, a museum, an alligator wrestling arena and a 12-acre lake.”

When Deputy Mayor Alan Greenberger testified to the state gaming board in September, he noted the connection between the proposed casino and Xfinity Live, and its potential to generate a more active street life in the area.

But the City doesn’t see that happening. “For this to be realized, the developer would need to develop and implement a proposal of high quality design standards for their project as well as for the street network between itself and XFINTY Live! However our experience working with the developer on the XFINITY Live! project would leave us with some concern about the likelihood of this happening,” Greenberger told the Commission. The city supports the build-out of XFINITY Live!, but feels the “quality of the building and surrounding streetscape … is less than what was originally proposed and expected,” he said.

The city’s economic analsyis also does not agree with Weinberg’s assertion that a stadium district casino would be the best bet economically. It reached the opposite conclusion, determining that the Market8 and The Provence – would make the most money and have the most potential to stimulate economic growth beyond their boundaries.

Weinberg called the city’s study “extremely flawed.”

He said it accepted the revenue projection numbers provided by the proposed casinos without considering whether the numbers were realistic. The Center City facilities have more gaming units, he said, but “just having more tables and more slots does not mean you’re going to do more revenue. The market is the market. If it was as simple as the more units you have the more revenue you’re going to do, then we would all put in infinite number of gaming positions.”

Weinberg said the study also did not give enough consideration to how successful casinos are designed. There was “no understanding of the importance of (automotive) access and parking,” he said. And “the multi-story casino design has not been terribly successful anywhere in the country.”

Weinberg noted that Wynn Resorts removed its $900 million Delaware Riverfront proposal from competition. Wynn has only said it was in response to increased competition in the region. “I believe strongly it was because they came to the realization a $900 million project didn’t make sense in the market place,” Weinberg said.

The scope and size of Live! Casino & Hotel – a $425 million project with 2,000 slots and 125 table games – is based on an analysis of what this market can support, he said.

When asked if Cordish and Greenwood submitted any sort of rebuttal to the city’s casino analysis, Weinberg said, “We actually did not think it was worthy of response.” He believes the PGCB will see the same flaws he does. “Anybody who understands the gaming industry would understand the study presented was not in keeping with industry standards.”

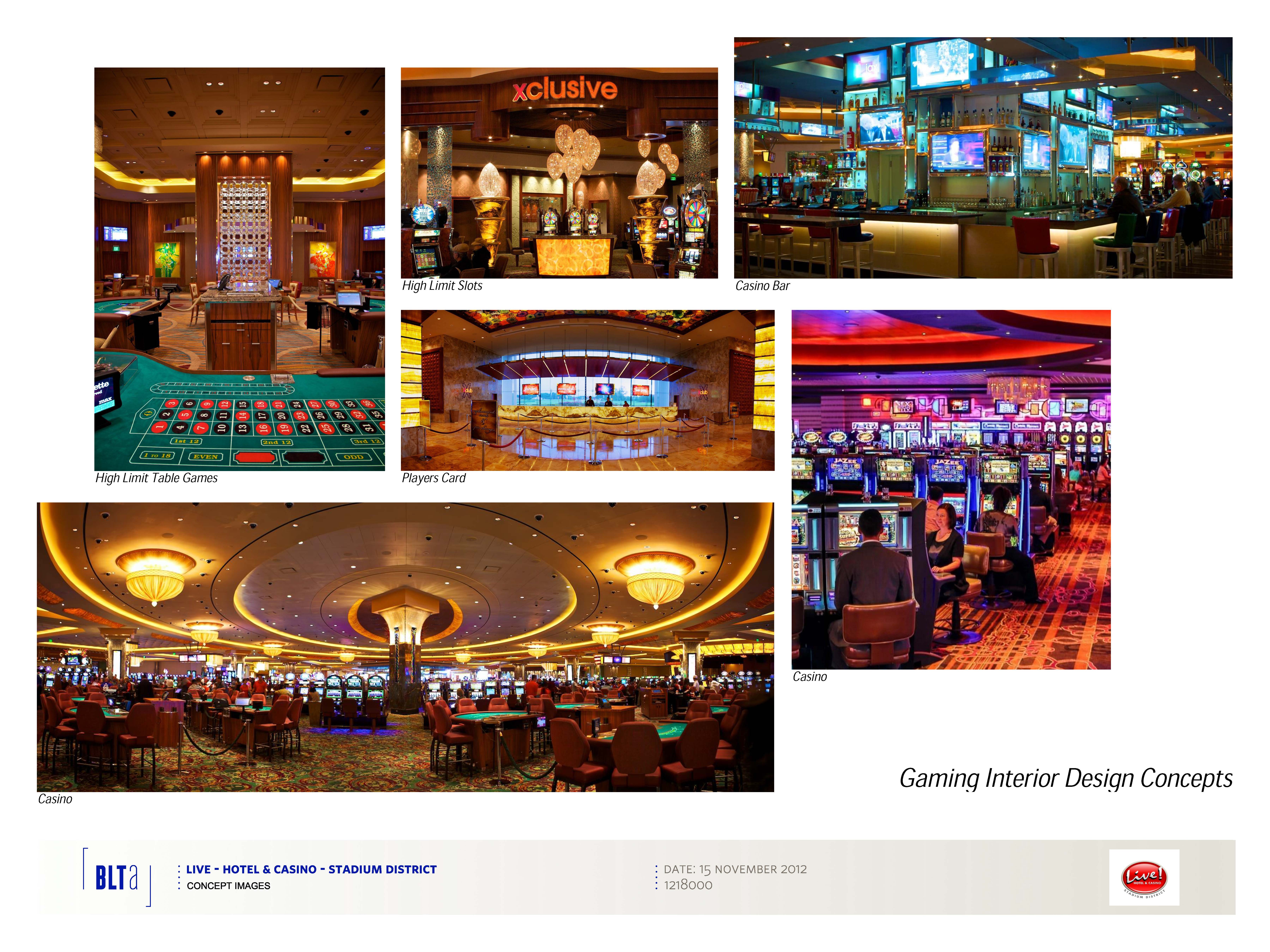

The Live! Casino & Hotel proposal includes 200 “upscale, boutique hotel rooms” created through the renovation of an existing hotel. (Weinberg wouldn’t speculate whether Cordish would still revamp the hotel if they don’t win the license.) The casino itself would be “comparable with anything you see in the newer properties on the strip in Las Vegas or Macao,” he said. It would include five restaurants, from white-table-cloth to quick-serve, and an 800-person concert space. A garage with parking for 2,600 cars would be attached to the site, and there are also large surface lots for overflow parking, he said.

The project would not be phased, he said, so all of this would be available on opening day – about a year after the start of construction.

“We are prepared to build out of cash,” Weinberg said.

Weinberg spoke extensively about how the existing stadiums and Cordish’s XFINITY Live! would help stimulate demand, and generate money, at the casino and hotel. When asked if there would be enough demand created to help other existing, non-Cordish businesses or spur new hotel and restaurant development, he said, “absolutely! The more there is to do, the more people we attract to the stadium district, the more we can create overnight demand. There is a tremendous spin-off effect. We expect people will come for events, (go to) the casino, and stay over in Philadelphia for multi-day visits.”

The area around Maryland Live! is “one of the fastest growing areas in the state. There’s been tremendous residential development around the site, and there are lots of new restaurants and hotels opening up around the facility.”

Weinberg expects the Live! Casino & Hotel’s primary market would come from a 60-mile radius around the site. The typical customer will be 35 or older, and will visit the casino fairly frequently. For a regional casino, “they typically range anywhere from 6 to 20 times a year. There might be people who come once a month, once every two months, or a couple of times a month,” he said.

The amount each will spend on gaming during each visit varies based on market, from about $75 per visit to $120. Weinberg compared that to a typical night out.

Many who oppose not just this casino, but all of them, are concerned about gaming addiction. Weinberg said the percentage of gamblers who have a problem is very tiny. Since this region already has casinos, awarding another license won’t create any new problem gamblers, he said, but it will pump more resources into gambling addiction programs.

All casino employees would be trained to recognize problem gambling, just as they are trained to recognize when someone has had too much to drink, he said. “Remember, we learn a lot about our customers,” he said. “If someone is acting beyond their known capacities, we will look at all those issues. … We can see by the way someone is betting, how much they are betting, how much time they are spending, we start to recognize patterns.”

Weinberg said it’s not good for customers, and it’s also not good for a casino to develop a reputation as a haven for problem gamblers. Dealers who suspect a problem could cut a person off from gambling, but they would typically call their supervisor. That person talks to the individual about seeking help, he said.

“We have millions of people coming. We don’t need one person, two people, or a handful of people who are playing irrationally or beyond their means.”

Weinberg said Cordish’s casinos are usually the “leader in the philanthropic community where we operate,” and this one would be no different. The team has touched base with the community groups in the area, and will provide money for parks and other amenities.

The casino would also help the region’s economy by hiring local workers. “We do a lot of (job) outreach in the local community,” he said, targeting people who live within 10-miles from a casino.

The Live! team and the other four casino license applicants will be in Philadephia next week, for three days of suitability hearings before the Pennsylvania Gaming Control Board. The Board is expected to award the license sometime in the first quarter of this year.

Note: Because Cordish has won waterfront development awards for its work on Baltimore’s Inner Harbor – it turned a former power station into a popular retail/restaurant/commercial destination – PlanPhilly asked Weinberg a bonus question. We asked how the two waterfronts compare, and whether Cordish might be interested in developing on the Central Delaware. See the answer near the end of the video, at the 53:47 mark.

PlanPhilly has had similar “Why should the state pick you?” conversations with all applicants. The final story, on Hollywood Casino, will run later this week.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.