Advocates for affordable communities call for anti-speculation tax

Are there ways to capture the rising tide that comes with new development while making sure it lifts more boats in the places changing most? Can the city do more to support bulwarks of affordability as neighborhoods appreciate, preserved in the name of community, diversity, and honoring those who lived through harder times in their neighborhoods?

At an announcement in City Hall’s Caucus Room Tuesday the Philadelphia Coalition for Affordable Communities offered one idea: a flip tax, which would increase the Realty Transfer Tax from 4% by an additional 1.5% for any property selling more than once within 24 months.

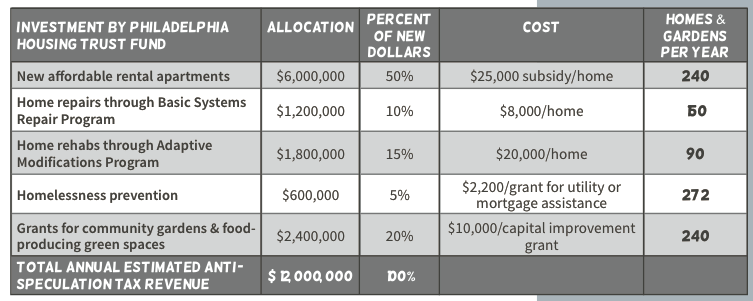

Research conducted for the coalition last year by Econsult found that increasing the Realty Transfer Tax from 4% to 5.5% on the roughly 6,000 properties that had sold twice or more in two years would have yielded an additional $12 million for the Housing Trust Fund in 2013. That increase would have effectively doubled the Housing Trust Fund’s revenue for 2013.

The Philadelphia Housing Trust Fund was established in 2005 to support housing preservation and repair, affordable housing development, and prevent homelessness. With double the resources it had in 2013, the coalition estimated the Housing Trust Fund would have been able to fund 240 new affordable rental apartments; assist 150 more homeowners with basic but critical repairs; help renovate 90 homes; provide mortgage and utility assistance to 272 families facing homelessness, and offer 240 capital improvement grants for community garden and food-producing green spaces.

While that’s a hypothetical breakdown of what could be done with a larger Housing Trust Fund, the need for housing choices that reduce the number of cost-burdened households is known.

As PlanPhilly’s Jared Brey reported this week, an analysis of housing affordability by the Philadelphia Fed based on recent census data found three quarters of the city’s renter population are low-income, and 70% of the lowest-income households in the city are significantly housing cost-burdened.

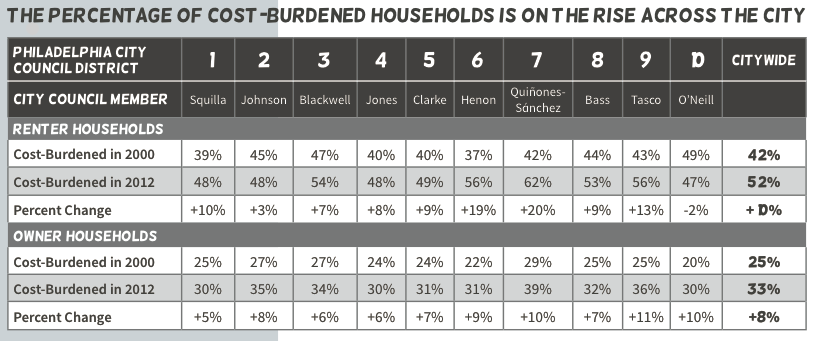

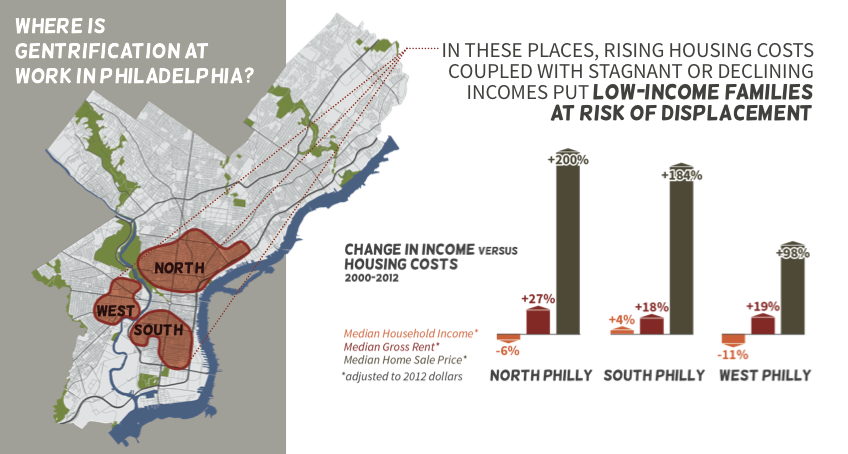

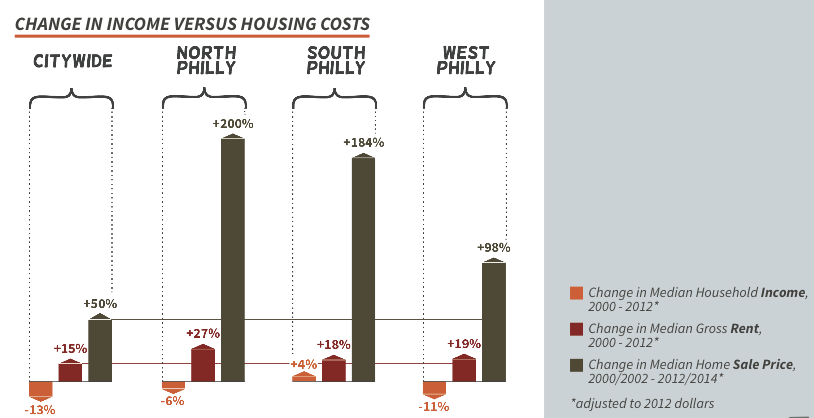

The Coalition for Affordable Communities’ report reached similar conclusions based on census data: Owner-occupied households were 33% housing cost-burdened in 2012, up from 25% in 2000. For renters the burden is worse: 52% of renter households were housing-cost burdened in 2012, up from 42% in 2000. During the same period housing prices in sections of North, West, and South Philly have boomed but household income has stagnated or declined.

City council will hold two hearings on the need for affordable housing (April 6 at 1pm) and possible policy solutions to meet this demand (April 27). The Coalition for Affordable Communities called on council to consider their flip-tax proposal.

Councilman Kenyatta Johnson stood with coalition advocates Tuesday, telling the crowd that the city must work harder to “find the tools and resources necessary to provide affordable housing on a mass scale.”

Johnson said he supported finding “creative ways to finance affordable housing,” though he has not yet taken a position on the concept of flip tax legislation. He said he would look more closely at the proposal and expressed interest in identifying new revenue sources to bolster the Housing Trust Fund and the city’s overall budgetary commitment to affordable and workforce housing.

Nora Lichtash, director of the Women’s Community Revitalization Project and coalition partner, said she believes Philly needs strong market-rate development because it strengthens the tax base, but also because in a rising real estate market there is opportunity to raise substantial resources that ensure more people can enjoy the benefits of neighborhood change.

Councilman Johnson, whose district includes neighborhoods like Point Breeze that serve as microcosms of the city’s development tensions, said he is pro-development but does not want new development to force displacement.

That concern is fore of mind for coalition members like Gwen Purnell, who said she has lived in Point Breeze for 60 of her 74 years, in the same house since 1970.

“As I see the city changing I wonder how long I will be able to stay in my own home,” she said.

A flip tax, advocates say, could meaningfully help offset some of the negative impacts of speculation by providing new resources for creating and sustaining affordable housing options citywide.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.