10 Philly neighborhoods reap the lion’s share of construction tax break benefits

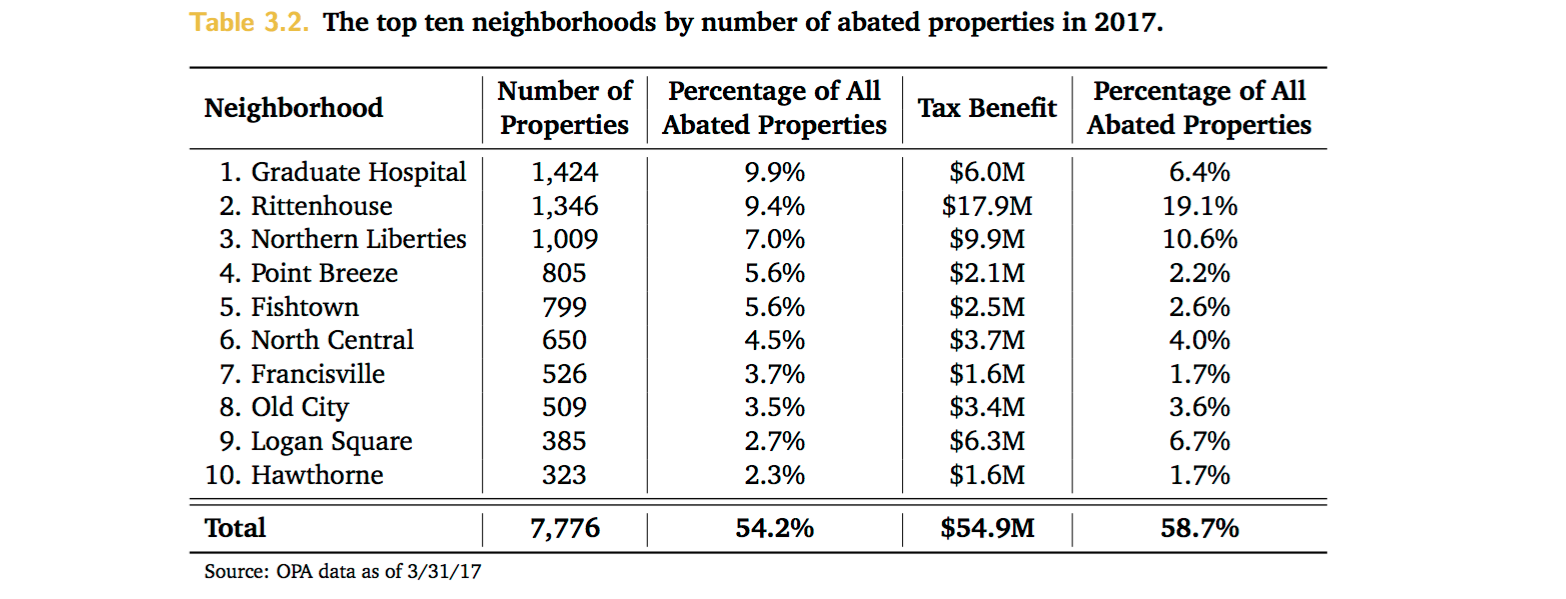

Ten neighborhoods concentrated around Center City make up 59 percent of the properties receiving Philadelphia’ controversial 10-year tax abatement, according to a report released Friday by City Controller Rebecca Rhynhart.

The analysis looked at the tax break’s geographical concentration, the distribution of its benefits and its impact on developer profitability. It also evaluated six potential alternatives to the current policy.

“My goal in looking at the ten-year tax abatement was to provide the Mayor and City Council with the information needed to make a data-driven decision as to keeping, ending or changing the policy. Incentivizing growth is important for the entire city, but it must be done in a fair and inclusive way. This analysis is a starting point for how to move forward as a city with that in mind,” Rhynhart said in a release issued with the report.

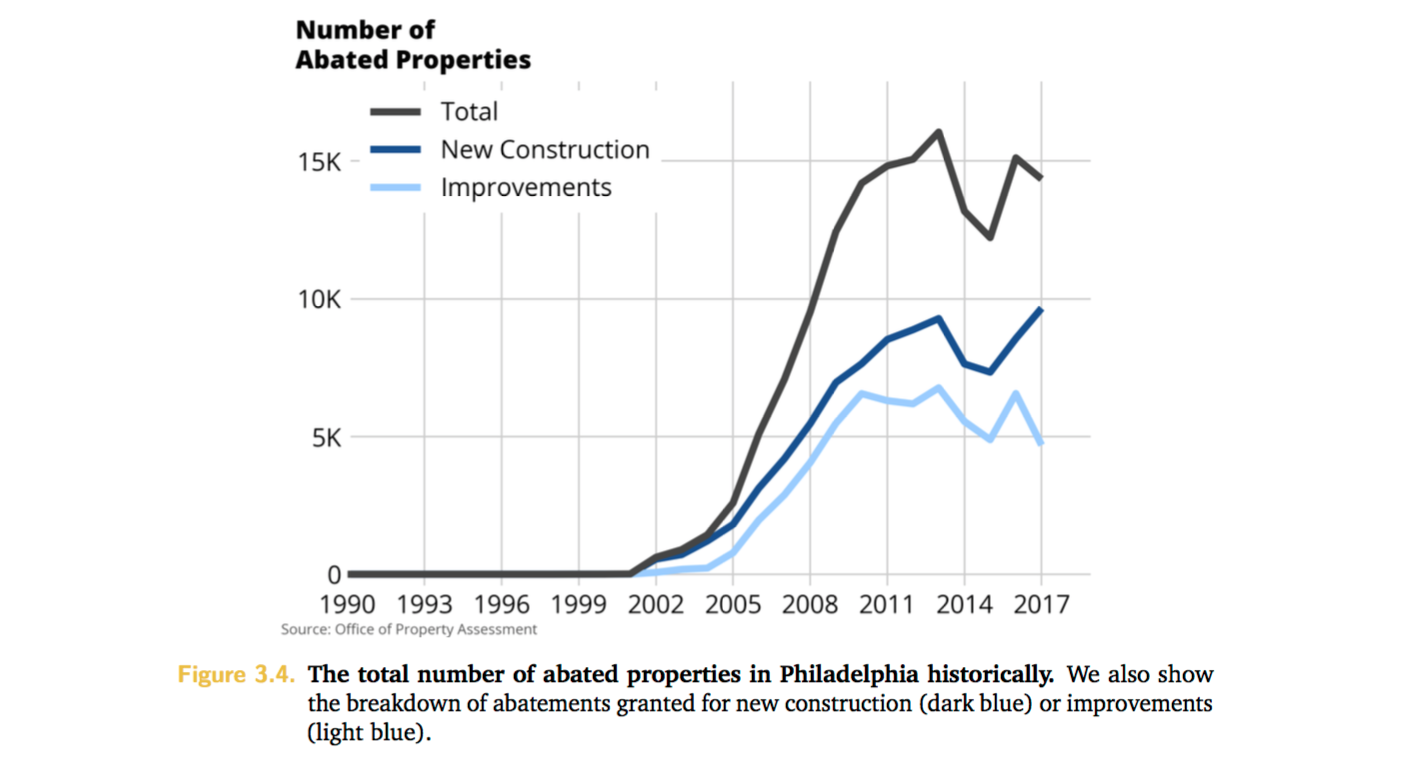

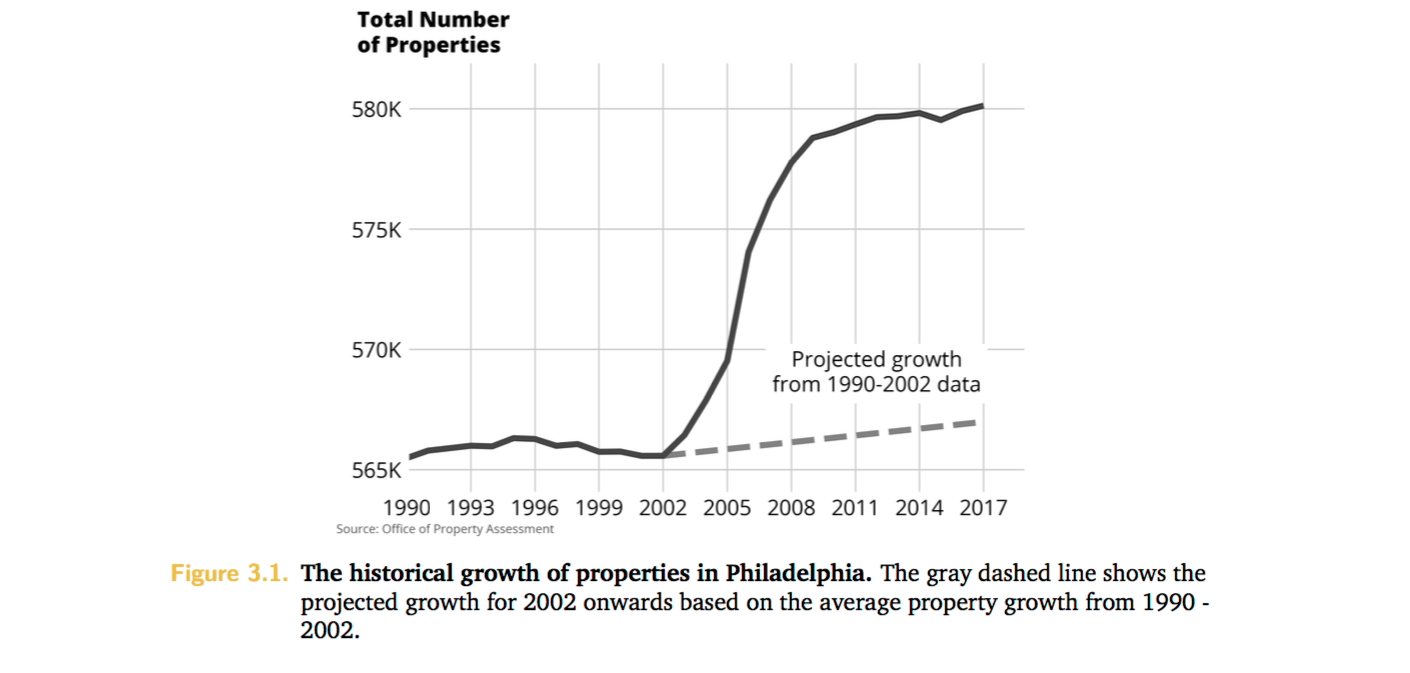

Studying historical data, Rhynhart’s office found that the total number of abated properties has “grown by approximately 15,000 over the life of the abatement and that [Philadelphia’s] regional share of development has increased,” signaling that the development incentive had achieved its goal of encouraging growth. The report also noted “significant appreciation” in the city’s median home values.

Other key findings include:

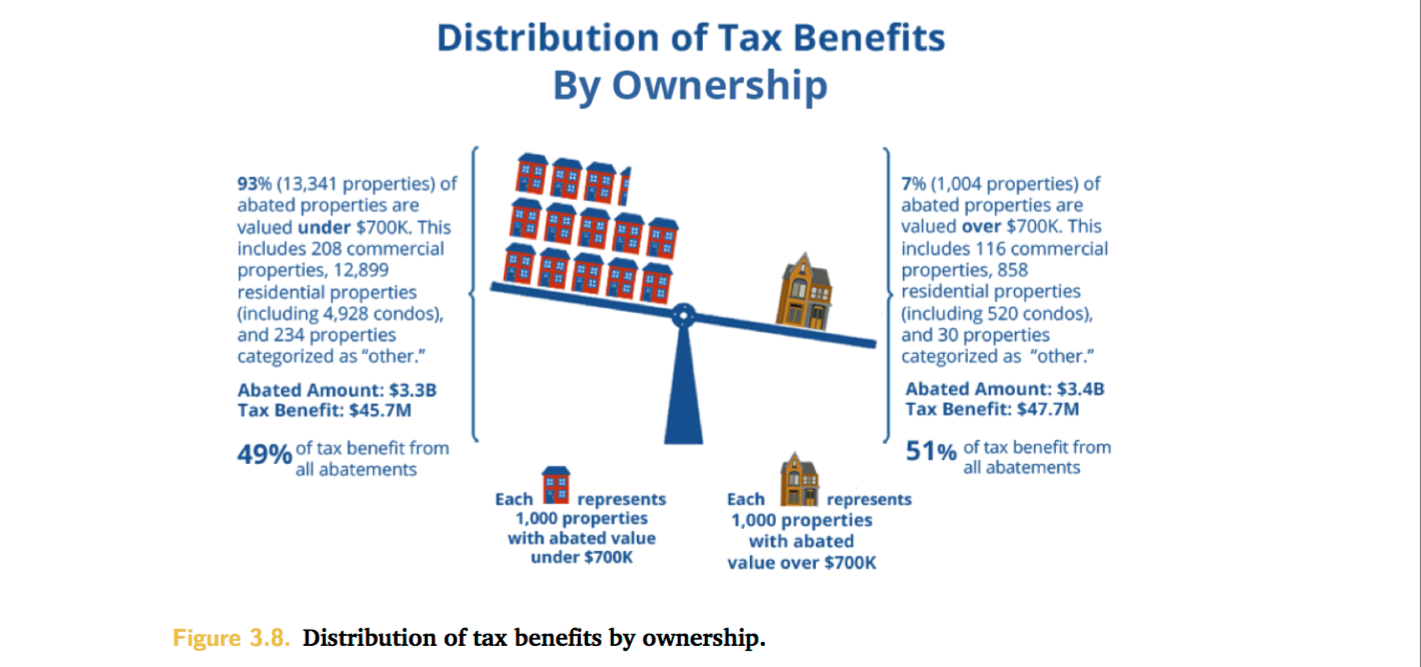

- Abated properties valued above $700,000 comprise just seven percent of actively abated properties, but receive 51 percent of the tax benefit from all abatements.

- The median home value per square foot for abated residential properties is $202, which is 93 percent higher than the citywide median home value per square foot of $105.

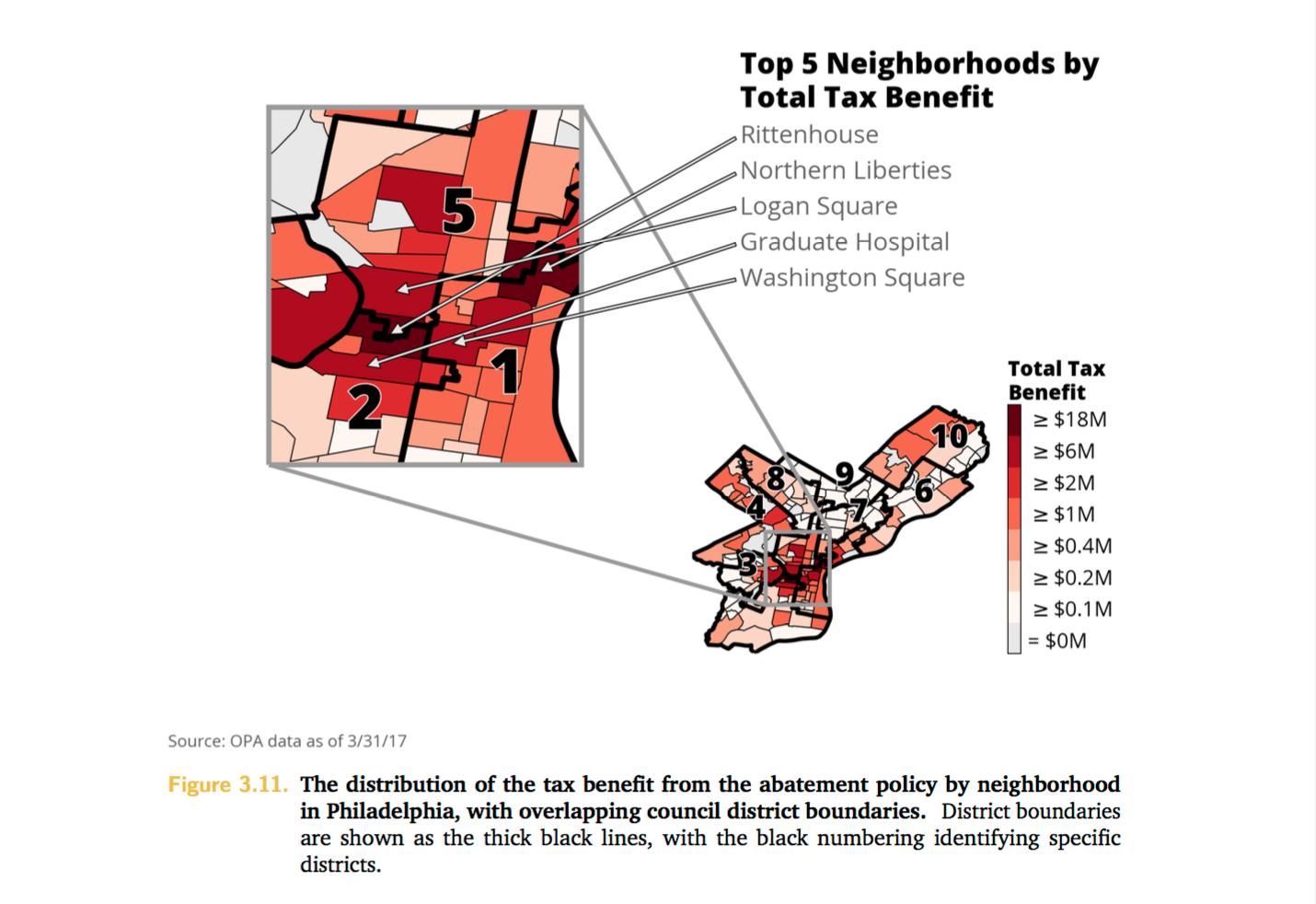

- In total, 59 percent of the tax benefit for active abatements go to just six percent of Philadelphia neighborhoods. Rittenhouse alone accounts for 9 percent of the total properties but benefits from 19 percent of total tax benefits.

The analysis also examined the profitability of development in Philadelphia, finding that “most ZIP codes are not profitable for development, even with an abatement.” However, the report also found that “the top ZIP codes for development are likely profitable regardless of the abatement.”

Finally, the report evaluated six hypothetical policy scenarios moving forward:

- · Rescinding the abatement completely;

- · Rescinding only the portion that funds the Philadelphia School District;

- · Capping the abatement at $700,000;

- · Capping the abatement at $150 per square foot;

- · Removing it in the most profitable ZIP codes; and

- · Amortizing the abatement over its lifetime.

City Council and Mayor Jim Kenney are responsible for the final decision to end, continue, or alter the tax abatement ultimately lies with. The report serves to inform the discussion with historical data, accurate analysis and a clear presentation of information. Read the full policy analysis here.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.