Deadbeat City: Philadelphia’s $515.4 million hole

If you read nothing else today, don’t miss Patrick Kerkstra’s story about the city’s deepening tax-delinquency epidemic, which is an update on his series about tax-delinquency from 2011.

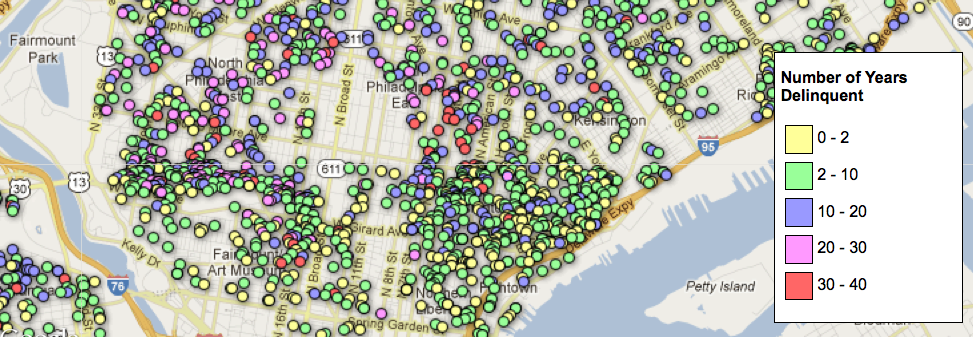

In short, Philadelphia’s tax-delinquency problem has become more costly over the last year, even as the total number of delinquent accounts has decreased. The city is owed $515.4 million – including penalties, interest, and principal – in property taxes. “The numbers speak for themselves. It’s ludicrous: half a billion in revenue still on the table, and more of it every day,” said State Sen. Michael Stack (D., Philadelphia), who wants the city to dramatically improve collections before asking tax-compliant property owners to pay more.

From April 2011 to April 2012:

- The amount of back taxes owed has increased by 9.3% or $43.8 million in a single year

- There are about 103,000 tax-delinquent properties – down by more than 8,000

- About 18% of all properties in the city are in arrears

As part of this collaborative project between PlanPhilly and the Inquirer, a condensed version of Patrick’s piece was published in the Inquirer this weekend. For the full version click over to PlanPhilly, and be sure to explore the updated delinquency map built by Rob Kandel and Frank Wiese at the Inquirer.

WHYY is your source for fact-based, in-depth journalism and information. As a nonprofit organization, we rely on financial support from readers like you. Please give today.